Today Make UK Modular launches new research on Modular’s role in solving the housing labour crisis. In this week’s edition of Manufacturing Mondays, we take a deep dive into the housing labour crisis. Read time 6 mins.

For years the UK hasn’t been building enough homes. House prices have risen faster than incomes for two decades, but housebuilding has stalled despite rocketing demand. In the 1970s, the UK was building more than 300,000 homes a year, but in the 2010s this had fallen to an average of just 165,000. The current government made a manifesto pledge to oversee 300,000 new homes built by the mid-2020s. But it looks certain to miss that target.

Housing completions and average house prices to earnings ratios, UK, since 1970

Source: Make UK Modular, 2023

Labour constraints are the underlying cause of the undersupply

The UK’s costly, restrictive and complex planning system is sometimes blamed for this market failure. But research published today by Make UK Modular identifies chronic shortages in construction’s labour market which have held back building and may mean delivery falls unless we radically change how we build homes. This is the underlying reason for the shortfall.

Since 2019, construction has lost over 100,000 workers.

There are now nearly 50,000 unfilled construction jobs, costing the industry £2.6bn in lost output.

The housebuilding sector has not grown its workforce substantially for the last 5 years.

Construction’s workforce is also ageing. 494,000 workers in the industry (21%) will retire in the next 10 years.

Only 11,000 apprenticeships are completed in the whole industry annually. They now make up less than a quarter of the number of workers leaving through retirement.

Previously the UK relied on EU labour to fill some of this gap, but Brexit means that employers and foreign workers must navigate our complex and costly immigration system. Training more domestic workers would help, but there are no plans to quadruple apprenticeships.

This means we expect the industry’s workforce to shrink – unchecked, construction may have 300,000 fewer workers in 2030. Yet government has objectives which will create additional labour demand: there’s the 137,000 extra workers housebuilding needs to meet the 300,000 homes target by 2030, but also the 220,000 additional workers needed to retrofit homes for the Net Zero strategy, and an extra 240,000 needed to meet other infrastructure commitments and other building.

Add in the 360,000 more workers needed just to replace retirees, and the construction sector looks set to require 950,000 extra workers by 2030.

The UK has no plan for recruiting and training this huge additional workforce, leaving construction with a shortfall of nearly 1 million skilled workers and potentially causing housebuilding to decline.

The construction sector’s labour force shortage in 2030

Source: Make UK Modular, 2023

Building differently: how modular sidesteps this problem

This is why we need to build differently. Modular housing offers a solution. Precision-engineered in factories, modular brings the efficiencies and quality control of manufacturing to housebuilding. This helps modular to sidestep construction skills and labour shortages:

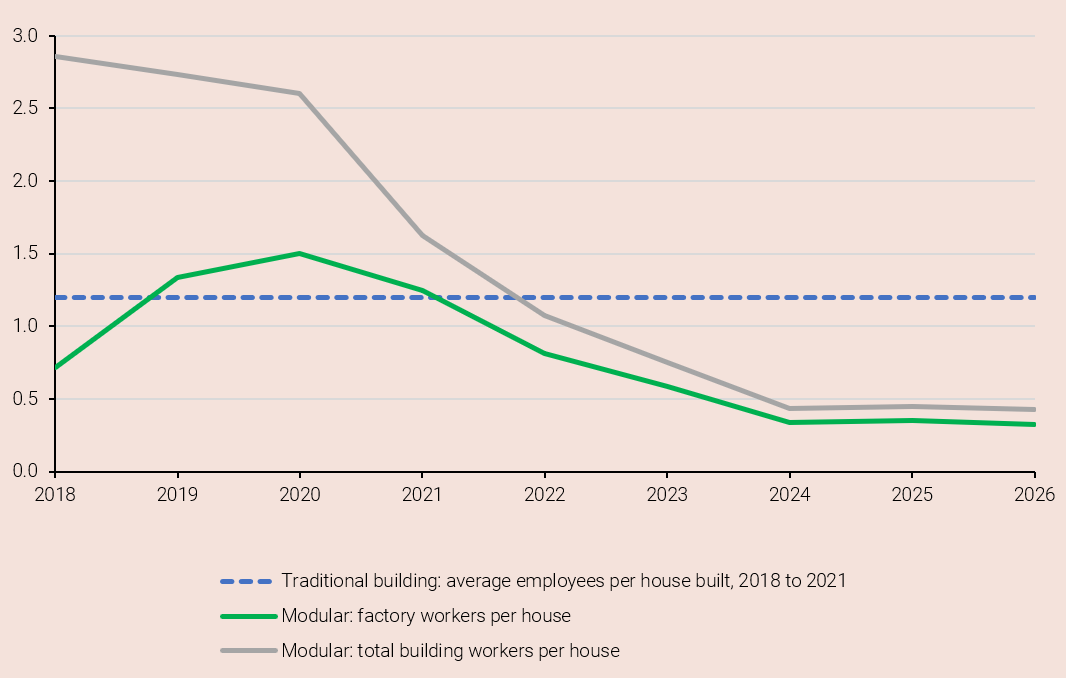

Modular house builders require up to 50% fewer workers to deliver the same number of homes. This helps build additionality in supply.

This also makes modular 40% more productive than traditional building.

Job roles are both manufacturing-focused as well as in construction meaning a larger pool of workers is available.

In many modular producers, only between 10 and 20% of staff are in sought-after construction trades; up to 65% can be in manufacturing roles.

The barrier to enter most factory-floor jobs in modular is often lower – many of our members have no entry requirements for these roles. However, opportunities to train up in-house are substantial.

Modular can tap into a wider and more diverse labour market.

The factory setting means that modular producers usually recruit factory-floor staff on full-time, permanent contracts with good, secure incomes, giving them good work where they live.

Factory-floor production is supported by highly skilled professionals – modular is helping to create skilled, high-value-added jobs.

Number of workers per house: modular v. traditional building

Source: Make UK Modular, 2023

This means modular can deliver the housing we need with fewer workers and without pulling sought-after trades from other sections of construction.

The UK needs to build 92,000 extra houses annually to reach the 300,000 homes target. Hypothetically, modular could deliver this with just 46,000 extra workers (half the rate of traditional building), of which only 5,000 to 10,000 may need to be in skilled trades.

This isn’t about replacing traditional labour or skills or putting people out of work. It’s about creating additionality in the market, meaning more homes, more jobs, more taxes paid into the Treasury, and more economic activity and growth. Traditional building can and must keep building, but modular can supplement what it does.

How to grow modular?

If the government is serious about building more homes, it needs to back modular – it won’t be able to build them without it. Therefore, we are calling on government to:

Remove the accidental double government levy charge on modular manufacturers by exempting them from the scope of the CITB levy.

Build supply chain capacity by repurposing the £10m allocated for the MMC Taskforce and using it to support a match-funded supply chain transformation programme based on those government has successfully delivered in aerospace, offshore wind, and nuclear.

Solve the housing crisis faster by dedicating 40% of the affordable housing programme to modern methods of construction.

These changes would cost no extra money but would help drive growth in the sector so that the UK can increase its housing supply.

Read the full report findings: Who will be the builders? Modular’s role in solving the housing labour crisis